Sales Tax Form Kansas . since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. How it works 🔎 overview this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as. kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. write your tax account number on your check or money order and make payable to retailers’ sales tax. • write your tax account number on your check or money order and. • you must file a return even if there were no taxable sales. write your tax account number on your check or money order and make payable to retailers’ sales tax.

from www.uslegalforms.com

since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. • you must file a return even if there were no taxable sales. How it works 🔎 overview write your tax account number on your check or money order and make payable to retailers’ sales tax. kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. write your tax account number on your check or money order and make payable to retailers’ sales tax. • write your tax account number on your check or money order and. this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as.

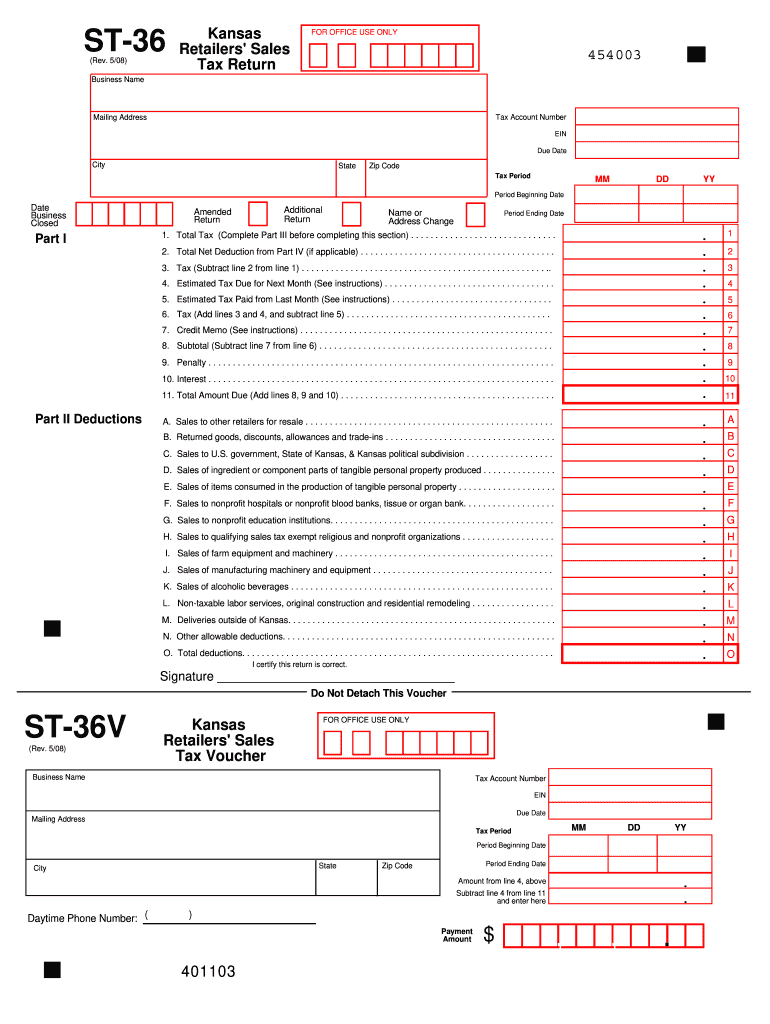

Kansas Retailers Sales Tax Return St 36 Fill and Sign Printable

Sales Tax Form Kansas since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. write your tax account number on your check or money order and make payable to retailers’ sales tax. kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. • write your tax account number on your check or money order and. this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as. since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. write your tax account number on your check or money order and make payable to retailers’ sales tax. How it works 🔎 overview • you must file a return even if there were no taxable sales.

From www.signnow.com

Kansas Sales Tax St 36 20212024 Form Fill Out and Sign Printable PDF Sales Tax Form Kansas write your tax account number on your check or money order and make payable to retailers’ sales tax. kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. • write your tax account number on your check or money order and. • you must file a return even if there. Sales Tax Form Kansas.

From marlastapleton.blogspot.com

kansas sales and use tax exemption form Marla Stapleton Sales Tax Form Kansas since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. • write your tax account number on your check or money order and. write your tax account number on your check or money order and make payable to retailers’ sales tax. kansas imposes a 6.5 percent (effective july 1, 2015). Sales Tax Form Kansas.

From silvanascully.blogspot.com

kansas sales and use tax exemption form Silvana Scully Sales Tax Form Kansas this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as. since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. • you. Sales Tax Form Kansas.

From www.pdffiller.com

Fillable Online How to Register for a Sales Tax Permit in Kansas Fax Sales Tax Form Kansas since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. write your tax account number on your check or money order and make payable to retailers’ sales tax. this booklet is designed. Sales Tax Form Kansas.

From www.pdffiller.com

Fillable Online Tax Exempt Certificate Kansas Fill and Sign Printable Sales Tax Form Kansas write your tax account number on your check or money order and make payable to retailers’ sales tax. kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. write your tax account number on your check or money order and make payable to retailers’ sales tax. this booklet is. Sales Tax Form Kansas.

From www.formsbank.com

Form St36 Kansas Retailer'S Sales Tax Return printable pdf download Sales Tax Form Kansas • write your tax account number on your check or money order and. since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. write your tax account number on your check or money order and make payable to retailers’ sales tax. • you must file a return even if there. Sales Tax Form Kansas.

From www.formsbank.com

Kansas Sales And Compensating Use Tax Instructions printable pdf download Sales Tax Form Kansas kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as. write your. Sales Tax Form Kansas.

From www.formsbank.com

Form St28b Statement For Sales Tax Exemption On Electricity, Gas, Or Sales Tax Form Kansas • you must file a return even if there were no taxable sales. since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. write your tax account number on your check or money order and make payable to retailers’ sales tax. • write your tax account number on your check. Sales Tax Form Kansas.

From www.adamsbrowncpa.com

Kansas Sales Tax Update Remote Seller Guidance Wichita CPA Sales Tax Form Kansas kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. write your tax account number on your check or money order and make payable to retailers’ sales tax. since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. How it works 🔎 overview. Sales Tax Form Kansas.

From www.formsbank.com

Form Pub. Ks1510 Kansas Sales Tax And Compensating Use Tax printable Sales Tax Form Kansas kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. write your tax account number on your check or money order and make payable to retailers’ sales tax. write your tax account number on your check or money order and make payable to retailers’ sales tax. • you must. Sales Tax Form Kansas.

From www.exemptform.com

Kansas Sales And Use Tax Exemption Form Sales Tax Form Kansas this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as. • you must file a return even if there were no taxable sales. write your tax account number on your check or money order and make payable to retailers’ sales tax. How it works 🔎 overview . Sales Tax Form Kansas.

From www.dochub.com

Kansas tax exempt form Fill out & sign online DocHub Sales Tax Form Kansas since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as. • you must file a return even if there were no taxable sales. kansas imposes a 6.5 percent (effective. Sales Tax Form Kansas.

From www.formsbank.com

Form K40 Kansas Individual Tax And/or Food Sales Tax Refund Sales Tax Form Kansas How it works 🔎 overview kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. • write your tax account number on your check or money order and. since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. write your tax account number. Sales Tax Form Kansas.

From www.formsbank.com

Form Pr78ssta Kansas Streamlined Sales And Use Tax Agreement Sales Tax Form Kansas kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as. write your tax account number on your check or money order and make payable to retailers’ sales tax. •. Sales Tax Form Kansas.

From www.formsbank.com

Form St36 Kansas Retailers' Sales Tax Return printable pdf download Sales Tax Form Kansas kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. • write your tax account number on your check or money order and. write your tax account number on your check or money order and make payable to retailers’ sales tax. How it works 🔎 overview this booklet is designed. Sales Tax Form Kansas.

From www.signnow.com

Missouri Sales Tax Form 53 1 Instruction Fill Out and Sign Printable Sales Tax Form Kansas • write your tax account number on your check or money order and. this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as. since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. write your tax account number on your. Sales Tax Form Kansas.

From www.formsbank.com

Form St21pec Sales And Use Tax Refund Application For Use By Pec Sales Tax Form Kansas write your tax account number on your check or money order and make payable to retailers’ sales tax. • you must file a return even if there were no taxable sales. How it works 🔎 overview since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. kansas imposes a. Sales Tax Form Kansas.

From www.formsbirds.com

Individual Tax Kansas Free Download Sales Tax Form Kansas kansas imposes a 6.5 percent (effective july 1, 2015) percent state retailers’ sales tax, plus applicable local. • write your tax account number on your check or money order and. How it works 🔎 overview since july 1, 2010, businesses have been required to submit retailers’ sales compensating use and withholding tax. • you must file a. Sales Tax Form Kansas.